Who is Morningstar? Morningstar is a highly respected independent research firm based out of Chicago, Illinois. The company was founded in 1984. Morningstar provides a host of investment products and services available for both novice and experienced investors. Their Morningstar rating scale is a popular method for evaluating mutual funds.

Three Key Points About Morningstar

- They provide research and analysis on everything from mutual funds, ETFs, bonds, and stocks. In addition, analyst perspectives along with real-time market data.

- Their products consist of print reports, mutual fund/stock screeners and calculators. Also, a host of online tools and applications designed to help investors evaluate different securities.

- Basic research information is available for free. Premium products and services are available via a paid subscription service for about $21 per month.

Related Posts:

- How to Open a Brokerage Account Online, In 4 Simple Steps

- All About Mutual Funds with Mutual Fund Examples

- What is a Real Estate Investment Trust (REIT)? – REIT Investing

- How to Create Passive Income Through a Dividend Income Strategy

- The Effect of Compounding Interest or Rate of Return

Why You Should Care?

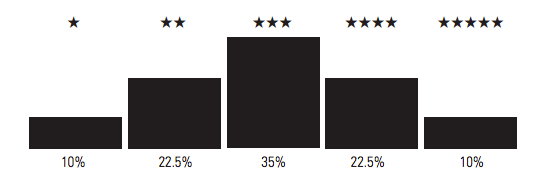

Morningstar is most well known for its “star rating” of funds (mutual funds, ETFs…). The star rating provides investors with a quick and easy way of evaluating a fund’s performance. The rating scale is one to five stars. One being the poorest rank and five being the highest rank.

Regarding the Morningstar Fund Rating scale:

- The rating scale evaluates funds based on past performance, fund manager performance, risk and cost adjusted rate of return.

- Ratings are based on the funds’ performance within their specific fund category. (funds with similar objectives and assets are grouped into categories to help evaluate their performance in relation to their peers)

- The top 10% of funds in a category are given a 5-star rating, the lowest 10% receive a 1-star rating.

- Funds are rated based on their three, five and ten-year performance. Funds with less than three years are not rated.

You can access the complete Morningstar Rating for Funds fact sheet here.

In Summary

The Morningstar rating is designed to provide investors with a simple means of doing a “first blush” on a fund. It is not designed to provide an overall recommendation on whether the fund should be purchased or sold. It’s a starting point, a way to narrow down the number of funds you may be evaluating.

Click on the links below to see an example of how the Morningstar Rating is used in relationship to T. Rowe Price and Fidelity’s mutual funds.

- Morningstar Rating of T. Rowe Price Dividend Growth Fund PRDGX

- Morningstar Rating of Fidelity ContraFund FCNTX

Helpful Resources:

- Wealthsimple – Automated Investing, Open an IRA Account, No Account Minimum0

- Personal Capital – All Your Financial Tools in One Place

- Motley Fool – Stock Advisor Sign-up

- Sign-up for Morningstar Services

Do you use the Morningstar rating scale to evaluate mutual funds? Comment below.